The European Commission wants households and business consumers “to be at the heart of” the EU’s upcoming European energy market reforms. This priority, which the European Council and European Parliament seem to support, makes sense as the potential gains for electricity consumers are enormous.

Consumers have already reaped at least half of the total benefits of power market coupling, estimated at 2.5–4 billion euros per year. Continued implementation of existing market integration legislation should deliver greater competition and the remaining benefits for consumers, and demand response, enabled through market design reforms, could bring significant additional benefits. But this is no easy task. Just how far we are from truly competitive markets is illustrated by the fact that, in around half of EU countries, the market share of the largest electricity producer is greater than 50 percent.

Renewable generation has grown rapidly, and energy consumption can now be easily controlled with smart digital technologies. Electricity market design needs to be adapted to these new realities. There is considerable political support for “demand response,” whereby consumers are flexible with respect to how and when they use energy. It is also recognised that digitalisation of the electricity sector could bring huge benefits for wider society and EU competitiveness.

Large energy consumers can respond directly to wholesale market prices, with or without the help of an energy service provider. Small consumers, however, will need the help of an energy service provider and access to retail prices or attractive retail contracts that are linked to wholesale prices in some way.

The success of demand response depends on three crucial elements:

- If consumers are to be increasingly exposed to time-varying prices, politicians, regulators, and market stakeholders must be able to trust that high prices are the product of scarcity and not manipulation or abuse of market power.

- Regulators must also ensure that markets are genuinely competitive. New entrants must be able to easily access the market. Energy suppliers could offer their consumers attractive demand response services, but many are vertically integrated via a mother company to an electricity generator. Generators use their supply businesses to hedge risk, and their primary business is to sell energy, so their motivation to provide demand response services will not be strong. However, competition from new entrants could be a motivating force.

- And finally, market design and rules must be adapted to allow aggregated energy demand to fully participate in wholesale markets, competing with energy generation. This is because energy service providers will need to pool the consumption of many consumers in order to provide the wholesale markets with reliable services using demand response.

Step change improvements to the monitoring of wholesale electricity markets—in terms of capacity, capability, and institutional arrangements—would help establish these three critical conditions. Better market monitoring could also help speed up implementation of market integration and liberalisation legislation more generally. RAP’s latest policy brief, Can We Trust Electricity Prices? The Case for Improving the Quality of Europe’s Market Monitoring, explains why better market monitoring needs to be part of the EU’s market design reform package. The highlights are explained below.

What Is Market Monitoring?

Market monitoring can be split into two categories:

- Market surveillance to identify and address wrongdoing; and

- Market performance assessment to examine and improve the economically efficient functioning of the market, including the efficient formation of prices when supply meets demand, usually referred to as “price formation.”

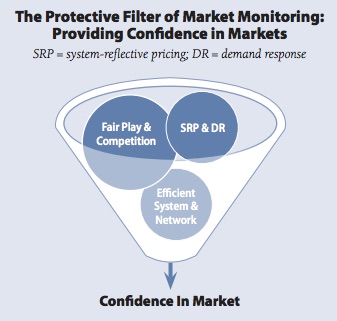

Market monitoring is like a protective screen or filter, crucial for rooting out any wrongdoing or anti-competitive behaviour and also critical to ensuring that markets perform as intended.

Market monitoring provides continuous surveillance and evaluation of the markets. It is like a protective screen or filter, crucial for rooting out any wrongdoing or anti-competitive behaviour and also critical to ensuring that markets perform as intended. A capable, credible, and adequately resourced market monitor plays an extremely important role in bringing objective facts and analysis to decision-making, revealing the benefits of well-functioning markets, and exposing the costs of suboptimal market design and market structure or lack of implementation and enforcement. This is a crucial role, the importance of which cannot be overstated given the very weak voice of consumers and new entrants relative to dominant incumbent power generators.

Better Market Monitoring Can Help Stop the Spiral of Price Interventions

Power market design reforms foresee greater price variability in wholesale power markets, more accurately reflecting the availability, or lack thereof, of energy, reserves, and services. Very high prices can easily cause concern for politicians and regulators, who might distrust the market and feel consumers are not able to respond to these prices. They might intervene in the market in order to protect consumers, as happened in the UK last year. (It is also worth noting that around half of EU countries are still regulating household electricity prices.)

Until now, consumers’ demand for energy has been relatively unable to respond to prices. But this could change with the help of energy service providers who can manage consumers’ energy demand by aggregating small loads and by using smart technologies. The business case of these service providers, however, depends on variable prices in wholesale electricity markets.

Once regulators intervene with price controls, generators might complain of low prices or “missing money.” Regulators might then intervene again to provide generators with additional revenue streams to ensure reliability. Unfortunately, these interventions, if badly designed, can further depress wholesale electricity market prices which in turn negatively affects the business case for demand response. If new entrants cannot get established or if incumbent energy suppliers are not motivated to encourage demand response from consumers, then the regulator will be more inclined to maintain price interventions. This is a negative spiral that is clearly difficult to break in the absence of effective market monitoring.

Best practice market monitoring could prevent unnecessary knee-jerk reactions by governments or regulators that lead to suboptimal market outcomes. An effective market monitor is ready to advise market stakeholders on high price events and can inform whether prices genuinely reflect the state of the power system or are the result of manipulation or abuse of market power. A responsive, credible, and capable market monitor can also give decision-makers the support and assurance they need when introducing pricing reforms, including advice on whether demand response is effectively participating in the market.

Better Market Surveillance Needed

Market Manipulation Is Costly for Consumers, and It Is Happening

Europe’s Agency for the Cooperation of Energy Regulators (ACER) is understaffed and therefore has struggled to effectively implement the Regulation on Wholesale Energy Market Integrity and Transparency (REMIT). Still, its heroic efforts have already produced dividends for EU consumers, as national courts have heard three cases. One case in particular reveals that pinching pennies on the quality of market monitoring, investigation, and enforcement is a false economy.

A small increase in the clearing price can cost consumers dearly due to the way EU power markets work. The clearing price is set when energy supply equals energy demand but the most expensive action taken to meet the combined demand for energy and reserves at that moment in time will set the price that will be paid for units of energy provided by all suppliers no matter what their original bid.

Thanks to implementation of the REMIT regulation, in 2013 Spain’s Iberdrola was found to have manipulated the market using its hydroelectric plants. According to the FACUA Consumers in Action group, while the manipulation resulted in profits of 21.5 million euros for the company, it actually cost consumers 105 million euros as the manipulation raised the clearing price by 7 euros per MWh, resulting in higher profits for all other generators dispatched. Iberdrola, however, was fined 25 million euros.

Sufficient Authority, Capacity, and Capability to Act on Wrongdoing

EU market surveillance is not sufficiently resourced to properly and promptly deal with companies that are not playing by the rules. As ACER is chronically under-staffed, it is very constrained with respect to the quality of analysis and support it can provide national regulatory authorities (NRAs), who are responsible for investigations and enforcement. Latest statistics reveal that the number of unresolved investigations are quickly accumulating.

Furthermore, some governments have not yet given NRAs the enforcement powers they need, as required by the REMIT regulation. The wide variation in penalties that NRAs of the EU28 use for enforcement is also problematic, particularly in countries where penalties will clearly be too weak to have the needed effect.

Better Market Performance Assessment Needed

Why This Is So Important for Consumers

While increases in the clearing price can cost consumers dearly, any decreases in the clearing price will benefit all consumers. As flexible electricity consumption, energy efficiency, storage, and interconnection have the potential to reduce clearing prices, their development can be a direct threat to the profits of incumbent energy generators and suppliers. These flexible resources, however, need to be promoted as they bring multiple benefits to participating consumers and wider society, including a dampening effect on extreme prices, either positive or negative, as well as lower average wholesale prices. Their development is directly dependent on efficient market design and market structure, fair play, and well-designed, targeted complementary policies, which have to be effectively implemented. Market monitoring provides assurance on progress with the development of these flexible resources (increasingly needed to help balance variable wind and solar energy) and evaluates their impact on markets.

Quality Data, Analysis, and Communications

When it comes to evaluation of market performance, decision-makers are simply not getting information that is sufficiently timely and detailed in order make well-informed decisions. In the EU, stakeholder confidence in the performance of wholesale electricity markets is low and could be addressed by a much improved market monitoring service. The market monitor must have access to the data it needs, in addition to sufficient resources and skills. Only then will it be able to provide appropriately detailed and relevant analysis. The market monitor must also be able to effectively explain findings to all stakeholders, including the general public, in a timely manner.

In Europe, ACER and the Council of European Energy Regulators (CEER) issue an annual market monitoring report that is some 300 pages in length, but covers both electricity and gas and all regional markets (28 EU countries). The European Commission issues quarterly electricity market data but provides no analysis.

In the United States, which has an installed capacity similar to, if slightly larger than, that of the EU (1.17 TW compared with 0.96 TW), market performance annual reports are produced by the market monitors of regional power markets. These annual reports are complemented by detailed quarterly reports in some regions. For example, the first quarter 2016 power market performance report of the PJM Interconnection (a U.S. regional market) runs over 500 pages and includes a detailed section on demand response, including its contribution to price formation. In Australia, market performance assessments are issued on a weekly basis and a short explanatory briefing is issued whenever prices exceed $5,000/MWh (Australian dollars).

The EU’s Market Monitoring Framework Needs Consolidation and Institutional Reform

Reform and consolidation would improve Europe’s market monitoring for a number of reasons:

- Market structure and market design can influence market participant behaviour. Established best practice illustrates the necessity and benefits of integrating market surveillance and market performance assessment. In Europe, the two are institutionally separated. Market surveillance is covered by the REMIT regulation, but the market performance assessment framework is more fragmented because it is covered by different laws. Such fragmentation also means that some overlap and confusion exists among the Commission, ACER, CEER, and the NRAs with respect to who is responsible for what.

- With greater market integration and cross-border trading, monitoring will increasingly need to be conducted at the regional or EU level.

- Many NRAs are under-resourced or small and would benefit from greater support from ACER, who should be adequately resourced to provide it, particularly for complex investigations.

- To be credible, a market monitoring mechanism needs to be independent, technically competent, transparent, and have the capacity and the latitude to properly scrutinise market data in a timely manner. Many of the recommendations of market performance assessment will be addressed to governments, regulators, and system operators. The independence of those conducting the analysis is therefore a very important consideration.

Market Monitoring as Part of the EU’s Market Design Initiative

Monitoring of wholesale electricity markets does not feature in the recent market design communications of the European Commission or European Council. The draft report on energy market design by the European Parliament’s Committee on Industry, Research and Energy, however, rejected comprehensive monitoring of the energy market by ACER, “since this would require the creation of a massive new authority.”

Since ACER, the European Commission, and NRAs are already monitoring power markets, albeit not effectively enough, the creation of a “massive new authority” would be a radical departure from existing arrangements. Nevertheless, the independence of market monitoring does deserve attention given experience from the United States, where some regional markets have created market monitors that are independent of the entities they are advising (e.g. regulator, system operator). The paper suggests several structural options to improve independence, one of which is to set up independent regional market monitors. Alternatives, however, could include adjustments to the internal institutional arrangements within ACER or a transfer of some of the data analysis function, currently housed in ACER, to the private sector through competitive procurement.

The top priority, however, clearly has to be ensuring that the EU’s existing wholesale electricity market monitoring service can at least meet the requirements of existing legislation. If just one thing is changed, it must be an increase in resources for both market surveillance and market performance assessment.

Ramping up the capacity and capability of Europe’s power market monitor is particularly necessary during a time of wholescale change, especially if market design reforms are to deliver anywhere near the full potential of consumer benefits. Europe’s power sector is subject to a raft of changing legislative requirements aimed at further liberalisation and market integration, modernisation and digitalisation, and pollution control. Market design and market structure will need to evolve over time, and the continuous evaluation provided through market monitoring will better inform decision-making and facilitate implementation. With improved market performance and sector stabilisation, once major change processes have come to an end, the effort required would likely reduce.