India’s quest to strengthen the long ailing power distribution sector has largely revolved around proposals to restructure the sector and redesign retail tariffs with periodic financial bailouts. These proposals show promise in alleviating present issues. It becomes crucial, however, to deliberate and critique these ideas and proposals through different lenses, especially when the sector is evolving rapidly.

Electricity, although a homogenous product, is highly sensitive — as matters of both demand and supply side — to factors such as time, location and weather. These factors are responsible for the varying economic and environmental costs of serving electricity. Unless these varying costs of supply are revealed to either the discom (distribution company), consumer, or a third-party aggregator to respond accordingly, it is challenging to take advantage of the cheapest and cleanest available resources. Increasing variability requires flexible demand to follow supply at times when clean electricity is abundantly available at lower costs.

Furthermore, with increasing access to electricity and rising demand from rural and semi-urban consumers, distribution companies have a heavy task to invest in upgrading their distribution networks, along with their portfolio of transmission and generation contracts. Alternatively, distributed energy resources (DERs), such as rooftop solar, bring multilayered benefits that include increased reliability to consumers and deferring capital investments for distribution companies. To aid their adoption, however, compensatory mechanisms that value their services are fairly important. In RAP’s Demand Flexibility and Distributed Energy Resources paper, we explore the efficacy of these different proposals keeping in mind two objectives – enabling demand flexibility and facilitating DERs.

Role of tariff design

Distribution companies have been growing wary of the increasing real-time demand-supply imbalance as generation from variable renewable sources increases. Similarly, electrification of various end-uses and rising demand for household appliances brings in variability from the demand side, but also presents an opportunity to take advantage of any flexible demand. In such a system, well-designed tariffs become crucial as they guide consumer behavior towards time periods where low-cost and clean power is amply available. This proposal isn’t novel and the proposition that ‘tariffs should be cost-reflective’ is often invoked, however, implemented for only select consumer categories with limited scope to be truly termed as cost-reflective.

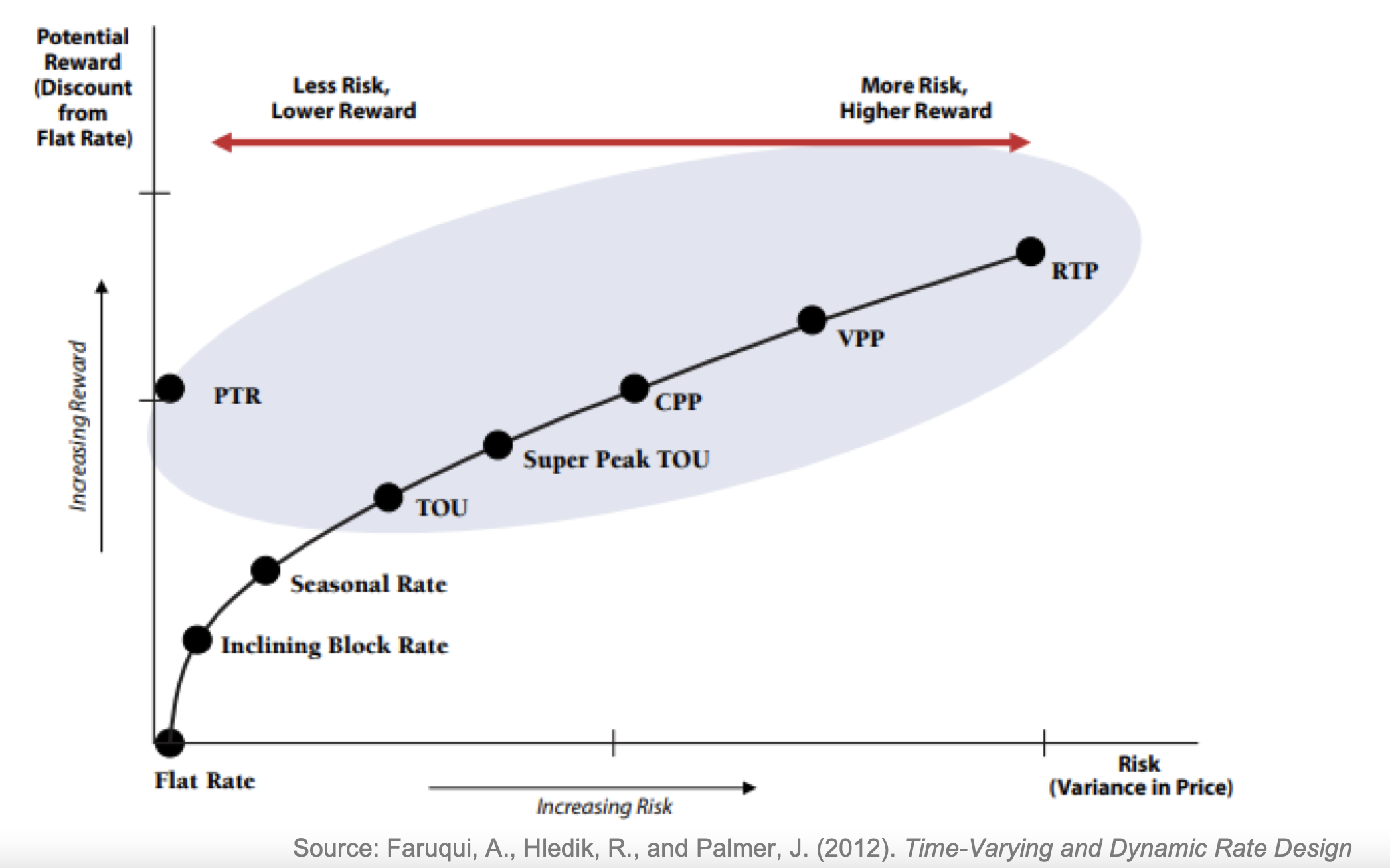

The spectrum of cost-reflective tariffs is wide. Seasonal rates at one end of the spectrum simply have at least two averaged rates that the consumers face in a year. On the other end, a completely deaveraged real-time tariff reflects the time-varying cost of electricity every hour. Several tariff designs fall in between these two and the role of discoms is to align rates, so consumers are able to see their costs of service. The relationship between time-varying rates and demand flexibility is widely studied and largely presents a strong positive correlation. It is important, however, to bear in mind that demand cannot be made flexible solely by implementing these tariffs. Effectiveness of time-varying tariffs amongst different consumers, and barriers to their adoption, is critical to understand and evaluate. Consumers, in addition to facing dynamic prices, must be able to understand and respond to those costs.

Conceptual representation of the risk-reward tradeoff in rate designs

Evidence from other markets reveal that peak consumption reduces as the peak-to-off-peak price ratio increases. Consumers with lower risk appetites are more inclined towards adopting tariff structures that provide rebates for reduced peak consumption as compared to consumption penalties. Enabling technology increases the ability of consumers to respond to price signals while reducing the financial risk associated with time-varying rates. Also, consumers’ interest in adopting such tariffs is dependent on their ability to understand the tariffs and potential risk-rewards.

Along with retail tariffs, well-designed compensatory tariffs for DERs are crucial in relaying value of production to “prosumers” (consumers who both produce and consume electricity) who install DERs versus the cost of consumption. These tariffs should also reflect the time-varying value of production in the same way retail tariffs would. Furthermore, to the extent possible, these tariffs should reveal the avoided costs of investments in generation, transmission and distribution, incentivizing the right form of DER deployment at locations where its most beneficial to the system and distribution companies. It is also equally important to implement a suitable metering and billing arrangement that influences the way energy flow is measured and financial benefits are communicated to the prosumer.

Looking towards a new market design with caution

Over the years, decision makers in have India visualized a market structure with multiple retail suppliers where the distribution business (or the “wires” business) remains with the existing distribution companies. To advance this, the Forum of Regulators had a devised roll-out plan, which detailed how the wires and supply business (also referred to as carriage and content, respectively) would be separated in the country. Similarly, privatization of state-owned distribution companies has been long debated with strong proponents on both sides. The driving force behind these proposals are usually legacy issues that have plagued the distribution sector for a long time. In addition to those (and as mentioned earlier), rapid developments in the sector also requires the decision makers to focus on newer objectives, such as demand flexibility and facilitation of DERs.

It is important to keep in mind that time-varying tariffs can be present in any structure, either through regulation or competition. Whether competition really leads to greater adoption of such tariffs is the real question. Experience in Texas and Australia suggests that tariff choices through competition alone may not lead to higher demand flexibility or higher adoption of DERs. For instance, offering multiple tariff options for all consumer categories may not be profitable for retailers and they would only be interested in creating tariff choices for large commercial & industrial (C&I) consumers. Even if retailers offer multiple options, consumers find it risky to adopt time-varying tariffs. Additionally, it is likely that the transaction costs of evaluating and shifting to a new tariff structure outweighs the potential rewards, therefore, few consumers voluntarily opt in. As a result, enabling technology and consumer awareness plays a significant role in ensuring that consumers are interested in and able to take advantage of dynamic prices.

For DERs, experience suggests that fair compensation requires strong policy guidance since markets alone cannot guarantee that prosumers are compensated for services provided to the grid. In Australia and Texas, not all states or cities mandate net metering or any other compensation to generation from rooftop solar. Retailers can choose to compensate prosumers as part of their pricing strategy. However, in the absence of compensatory tariffs that put a value on electricity from rooftop solar injected into the grid, prosumers are incentivized to only consume all generation to maximize their benefits. Regulators and policy makers do have a critical role, even in lightly regulated market structures, to ensure consumer interests are secure and there’s enough direction in place for the stakeholders to adopt strategies that aim towards a common larger goal.

Emerging transactive models

Innovators in the sector have been experimenting with newer transaction models that appeal to the changing dynamics of consumption and production directly. Several of these models are based on distributed ledger technology, which blockchain is a well-known example. The fundamental value proposition is that everyone in the system can interact with each other, responding to price signals in a transparent, secure and seamless manner. Such systems where consumers, prosumers, or “prosumagers” (prosumers with storage) can buy and sell electricity directly are termed as peer-to-peer (P2P) networks. For example, large C&I consumers in special economic zones or commercial parks can further take advantage of rooftop solar, thermal storage and battery storage, and the heterogeneity in demand between them to transact on such networks. These models are, however, in their nascent stage and countries are still experimenting through ‘regulatory sandboxes.’ Regulatory sandboxes allow these models to be tested in a controlled environment with freedom to relax existing regulatory norms, if required. So, while it is important for regulators and policymakers to stay updated with these developments, they must allow enough business models to flourish before they take steps to convert them into regulations and policies.

As India looks to unlock the full potential of cost-efficient clean energy sources, it will be essential to understand the role of demand flexibility and DERs. Currently, these objectives don’t stand out as India’s distribution sector is mired in legacy problems. It is important, however, to realize that their benefits extend beyond just renewable integration. Distribution companies can reduce peak power procurement costs and avoid or defer distribution network upgrades and other upstream costs. Enabling demand flexibility and facilitating DERs will complement rather than distract in resolving existing issues and allaying concerns regarding the changing power system.