In December 2023, RAP and CLASP published “Accelerating Heat Pump Adoption through the Inflation Reduction Act (IRA) and Complementary Policies.” Using a modified U.S. Department of Energy (DOE) model, the authors analyzed the impacts of incentives on heat pump adoption and found that the High-Efficiency Electric Home Rebate Act (HEEHRA) and Nonbusiness Energy Property Tax Credit (25C) would jointly lead to 1 million furnace households installing heat pumps for space heating. This would increase the number of heat pump-heated households from 13.7% to 14.5%, or by only 0.8 percentage points.

One of the issues identified was that the HEEHRA incentive (up to $8,000 per heat pump for low- and medium-income households) was too generous relative to the total program budget. By the authors’ estimate, the portion of the program budget set aside for heat pumps — $2.57 billion, or 8/14 the $4.5 billion total, based on the ratio of the heat pump incentive to that for the household maximum — would be spent in four months, leading to the installation of only 362,000 heat pumps. We asked ourselves, “Could a smaller incentive lead to more installations?”

Sensitivity Analysis

According to the logic of the modified DOE model, lowering the maximum incentive would cause the households with the worst economics to drop out of the program. For example, if the incentive were to decrease from a maximum of $8,000 to $7,000, households for which the heat pump cost between $7,000 and $8,000 more than a furnace (over three to four years) would no longer apply for the incentive as it would not cover the cost difference. Instead, the budget would be distributed among the households with a cost difference less than $7,000.

As the maximum incentive amount decreases, there will not be enough households in need of a furnace replacement with favorable economics to claim the incentive and use up the budget in one year, and the remaining budget would be available for households in a subsequent year. Eventually, there are so few households claiming the decreasing incentive that the budget will not be spent within the duration of the program (which is set to end in September 2031, so we modeled the seven years from 2025-2031).

There are therefore two constraints: budget and time. Too high an incentive and the budget will be spent early; too low an incentive and the time will run out before the budget is spent. The optimal incentive amount will spend down the budget in exactly seven years, leaving no budget or time on the table.

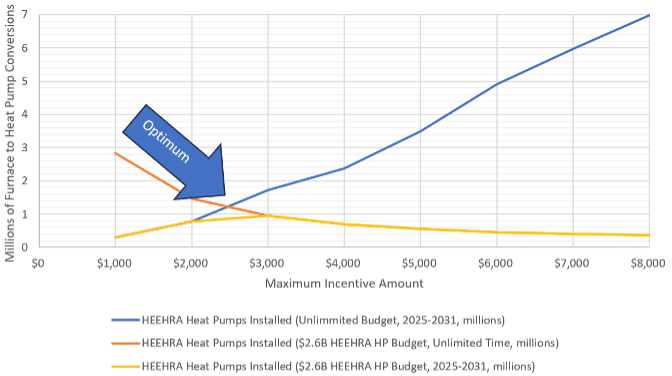

The two constraints are illustrated in Figure 1, below. The blue line represents the time constraint only, while the orange line represents the budget constraint only. The yellow line, which follows the lower of the two lines represents both constraints. (This sensitivity analysis was run in steps of $1,000, so the yellow line does not exactly follow the two other lines between $2,000 and $3,000.) The optimum occurs where the two lines cross at a maximum incentive amount of approximately $2,500. With this incentive amount, approximately 1.2 million furnaces could be converted to heat pumps over the seven years of the program, or three times more than under the $8,000 maximum allowed by statute.

Figure 1. Heat pumps installed with different HEEHRA incentives under time and budget constraints ($2.57 billion heat pump incentive budget)

Given the uncertainties in the model, $2,500 may not be the actual optimal maximum incentive. However, the modeling indicates that a maximum incentive between $2,000 and $3,500 would lead to twice the conversions compared to the $8,000 maximum, so a non-optimal maximum incentive would still provide benefit. By extending the period over which the incentive would be available, a lower incentive would also avoid the boom-and-bust problem where customers and installers get motivated only to be disappointed when the funding runs out.

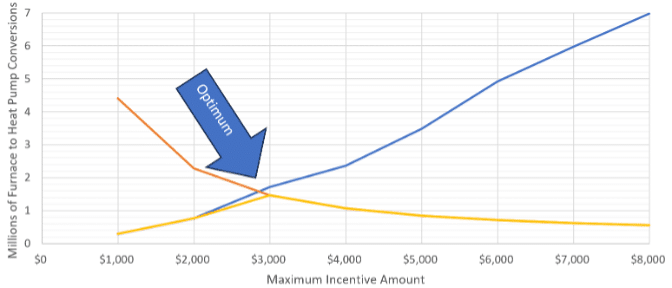

Figure 2, below, shows an additional sensitivity on the total HEEHRA incentive budget available for heat pumps, increasing it to $4 billion under the assumption that most of the budget will be used for heat pumps. As can be seen, the total number of heat pumps incentivized increases, and the optimum point moves to a maximum incentive of approximately $2,800.

Figure 2. Heat pumps installed with different HEEHRA incentives under time and budget constraints ($4 billion heat pump incentive budget)

Recommendations

As mentioned in RAP and CLASP’s paper, additional policies at the state level will be necessary to supplement the IRA incentive. States wishing to continue an incentive after the IRA funding runs out may want to conduct a similar sensitivity analysis to determine the optimal incentive under their total budget and time constraints.

More immediately, this sensitivity analysis indicates that states may be able to double their impact if they lower the maximum incentive amount in their proposed HEEHRA programs.