Following several years of strong growth, heat pump markets slowed in Europe in 2023. In previous articles for Carbon Brief, we discussed this initial surge in 2021 and explored the impact of the energy crisis in 2022. Yet, despite a drop in heat pump sales in key European regions, the trends in 2023 are more nuanced than an outright downturn.

Heat pumps generally increased their position relative to fossil heating systems and, in some of the continent’s biggest heating markets, they saw continued growth. If policymakers want to keep the transition to low-carbon heating on track, then thorough, consistent and coordinated policy efforts remain critical to scaling up heat pump markets.

Heat pumps in Europe falling short of 1.5C path

In 2023, the market’s expansion hit a plateau, as shifts in policy, changing energy prices, a stagnating economy and backlash against climate initiatives adversely affected sales in several nations. Across the continent, there was a general downturn in sales by about 5% compared with a year earlier, as shown in the figure below.

Note: “Rest of Europe” includes Austria, Belgium, Denmark, Finland, Norway, Poland, Portugal and Switzerland.

Source: European Heat Pump Association Market Statistics. (2024). Chart by Carbon Brief.

The impact was more pronounced in the segment of air-source heat pumps for space heating, with a 12% decrease in air-to-water and a 10% fall in air-to-air sales. Conversely, the segment for sanitary hot water heat pumps — those used for heating water for use in the home — saw significant growth, surging by nearly 20%.

However, while still high in historical terms, these sales are far from what is required to meet climate goals. The EU will need around 60m heat pumps by 2030 to get on track for net-zero by 2050, according to modelling from the European Commission.

The aggregated statistics presented above show that, as of the end of 2023, there were roughly 23m heat pumps across the 21 EU nations included in the data. (The figures also include, under “Rest of Europe,” three non-EU countries, the UK, Norway and Switzerland, while excluding smaller EU markets.) That means that roughly 6 million installations would be needed per year out to 2030, in order to hit the 60m milestone, whereas the current pace of growth is closer to 2.5m per year.

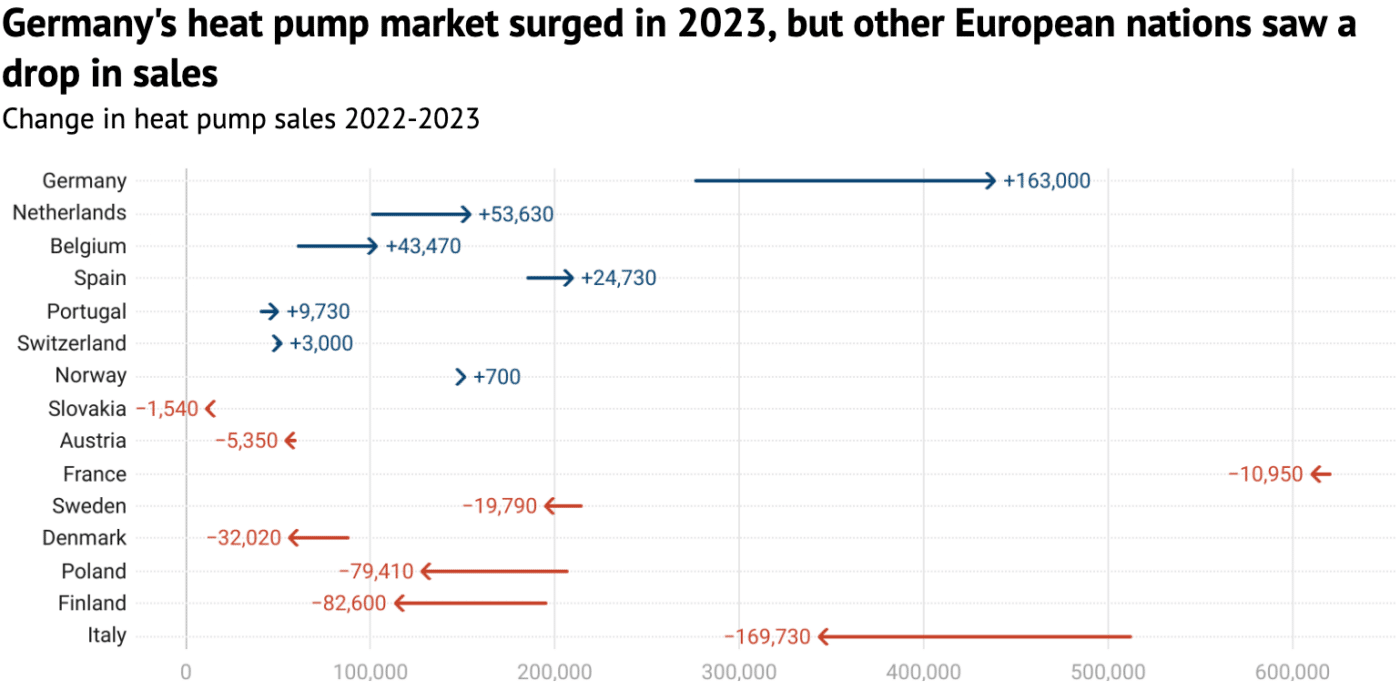

Trends in 2023 went in the opposite direction to what would be required. Among the countries accounting for the largest decline in sales were Italy, Finland and Poland, as shown in the figure below.

According to market statistics from the European Heat Pump Association (EHPA), Italian sales fell to around 345,000 units in 2023 compared 514,000 the previous year, a decrease of 33%. In Finland, some 114,000 heat pumps were sold compared to nearly 200,000 in 2022. And in Poland, the market fell to 129,000 units after reaching 208,000 in 2022.

Source: EHPA Market Statistics. (2024). Chart by Carbon Brief.

While the European market contracted overall, several individual countries saw strong market growth. In Germany, sales increased by 60% year-on-year from 276,000 in 2022 to 439,000 in 2023.

In the Netherlands, 154,000 heat pumps were sold, a 53% increase on 2022 levels of roughly 100,000. Belgium experienced Europe’s largest market increase at 72%, breaking 100,000 sales for the first time.

In the UK, trade group the Heat Pump Association reported annual growth of 4% to reach more than 60,000 units sold. This data includes air-to-water and ground-source heat pumps, but does not account for air-to-air and is, therefore, incomplete.

Heat pumps gain market share

The decrease in the European market is moving in the opposite direction to what would be required to meet Europe’s decarbonisation goals. Nevertheless, the overall picture is more nuanced.

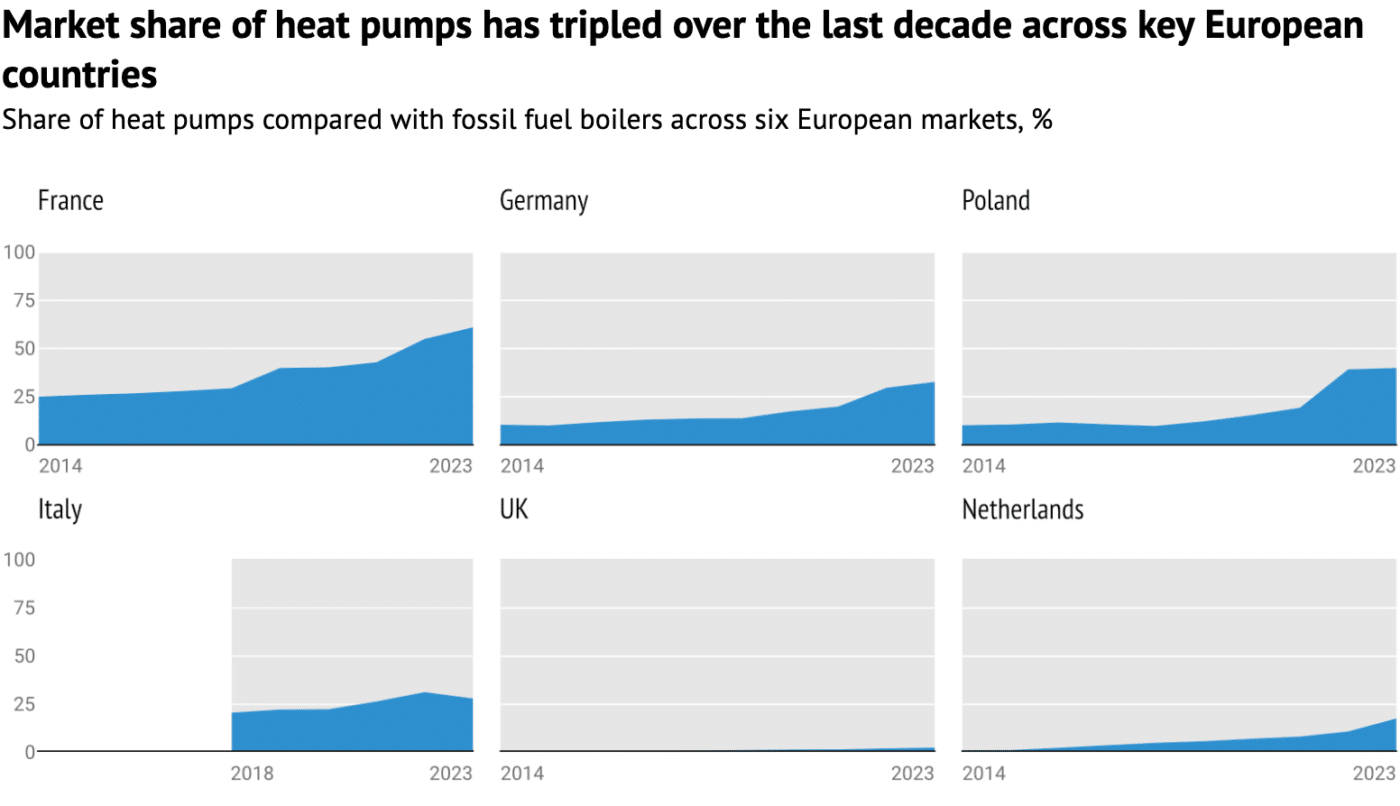

For example, in certain countries predominately heated by fossil fuels, heat pumps have continued to gain market share. France is the leader in this regard. The market share of heat pumps has been steadily growing over the past decade, with more heat pumps sold than gas and oil boilers for the first time in 2022. This French trend continued in 2023, as shown in the top left corner of the figure below. Fossil boiler sales fell sharply by 23%, allowing heat pumps to reach 61% of the heating market despite also seeing a small fall in sales.

Germany (top centre) has seen the heat pump market share steadily increasing year-on-year from around 10% in 2014 to 33% in 2023. Despite a booming fossil heating market, enough heat pumps were sold in 2023 that their market share continued to grow.

In Poland (top right), although the market share of heat pumps plateaued in 2023, it has risen significantly to 40%, from just 10% in 2018. The Netherlands (bottom right) has also seen a rapid shift, with 18% in 2023 compared to 1% in 2014.

Italy’s heat pump market share (bottom left), which is more stable, contracted in 2023 after two years of growth. In the United Kingdom (bottom centre), heat pumps have roughly tripled their market share in five years, but from a very low base. Excluding air-to-air heat pump sales, only around 60,000 units were sold in 2023, with a current market share of roughly 3%.

Considering all six countries together — the largest markets for heating installations, all of which still have gas boilers as their predominant heating technology — the market share of heat pumps has tripled from around 8% in 2013 to 24% in 2023.

Sources: Heat pump sales from EHPA Market Statistics. Sales for boilers from Uniclima (France), BDH and Umweltbundesamt (Germany), SPIUG (Poland), Assotermica (Italy) and BRG (Netherlands and UK). Chart by Carbon Brief.

A challenging outlook

European countries are facing diverse challenges to growing heat pump sales. The plateauing of heat pump sales in France, Europe’s largest market, is a key example of this.

On the one hand, the French government cut funding to one of the main heat pump support programmes by €1.4bn while announcing an increase in electricity tariffs. On the other hand, the regulator also announced a hike in gas tariffs, linking it directly to a decrease in gas consumption, among other factors, including the removal of a price cap.

This indicates an escalating financial vulnerability for customers remaining on the gas network in France. The heating industry expects a further contraction of the boiler market in 2024, although not at the pace seen in 2022-2023.

Elsewhere, the 2022-2023 heat pump market surge in Germany is not expected to continue, RAP analysis suggests. Already in the latter half of 2023, installations had slowed compared to the previous year, as had applications for the country’s subsidy programme.

This is largely linked to Germany watering down its Building Energy Act. It remains to be seen to what extent mandatory municipal heat planning, part of the EU’s revised Energy Efficiency Directive, will drive an uptake of heat pumps in the coming years.

Poland was Europe’s fastest-growing market for heat pumps in 2022, with a 120% increase in sales in a single year. The 46% contraction of heat pump sales in 2023 was largely driven by a 40% drop in the single-family home boiler market, with total sales of fossil fuel heating systems falling in turn. As a result, heat pumps maintained their market share in 2023.

However, the unfavourable price ratio in Poland, typically more than three times as expensive for electricity as for gas, remains a key challenge. The recently elected government is considering policy reform options to address this, however.

Italy’s steep market decline, especially for air-to-water heat pumps, which fell by more than 50%, moves the country in the wrong direction for decarbonising its heating sector. The country’s 2023 heat pump sales were even lower than in 2021.

Key reasons for this include changes to the Superbonus energy efficiency support program, which lowered its reimbursement rate from 110% to 90% and a tightening of eligibility for the scheme.

The heat pump market in the Netherlands was one of Europe’s fastest growing in 2023. While there was a decline in sales in the country during the last quarter of 2023, due to supply chain constraints, the long-term outlook is for further growth. The market is expected to remain at similar levels throughout 2024.

However, regulation expected to come into effect in 2026 that would have phased out installations of stand-alone fossil fuel heating systems is now expected to be scrapped. The new Dutch right-wing coalition government announced a u-turn on the policy along with a raft of other climate measures in May.

In the UK, the heat pump market expanded slightly in 2023 compared to 2022. With around 60,000 units installed, however, it is well off the government’s target of 600,000 installations per year by 2028. In October, heat pump grants under the boiler upgrade scheme were increased from £5,000 to £7,500.

The government also recently confirmed that, from 2025, new homes will no longer be allowed to install fossil fuel heating systems or so-called “hydrogen-ready” boilers. This will result in a substantial market boost of more than 150,000 additional units per year, RAP analysis suggests, assuming most new homes will include heat pumps.

However, there is continued uncertainty around the clean heat market mechanism, the main instrument expected to drive heat pump installations in existing buildings.

A one-year postponement of the scheme — which will set a rising standard for heat pumps as a proportion of fossil fuel boiler sales — was recently announced following pressure from the gas boiler industry.

At EU level, previously strong indications of support have begun fading. The European Commission has delayed its heat pump action plan, which would have continued to lay the groundwork for the rapid expansion of the technology across the EU.

More than 60 chief executive officers across the heat pump industry criticised the decision, warning that it risked billions of euros in investments.

At the same time, the European Parliament and the European Council recently passed the revised Energy Performance in Buildings Directive, which will prohibit subsidies for standalone fossil fuel boilers after 2025 and aims for a full phaseout of fossil fuel boilers by 2040.

Consistent policy remains key

Heat pumps are the “central technology” for low-carbon heat, and rapid growth in their market share is crucial for meeting national and international climate goals.

After expanding rapidly in 2021 and 2022, the plateau in the European heat pump market in 2023 highlights the impact of inconsistent policies in denting their long-term growth.

The variance in market performance across countries — stemming from a mix of policy shifts, funding cuts and regulatory changes — underscores the complexity of scaling heat pump technologies rapidly enough to meet Europe’s decarbonisation goals.

Nonetheless, far more heat pumps are being installed than in previous years and heat pumps are continuing to gain market share in Europe’s largest heating markets.

RAP analysis shows that consistent and forward-thinking policy packages are likely to be key to boosting this trend. Such interventions could lower the upfront cost of heat pumps and ensure their running cost competitiveness, as well as providing the industry with the market certainty necessary to spur investment, innovation and consumer confidence.

A version of this article originally appeared on Carbon Brief.

Photo: MAXSHOT from iStock.