Europe is racing to meet ambitious 2030 and 2050 climate goals but is still stumbling over one of the foundation stones of a cost-effective clean energy transition—investments in end-use energy efficiency. While this month’s “yellow vest” protests in France are not focused on the emissions trading system (ETS), they are a striking reminder of how hard it is to meet our climate goals just by raising the cost of energy. Carbon prices are important, but we also need energy-saving programmes that deliver bill savings and cleaner air for citizens, and more competitive economies for EU Member States.

The European Parliament recently ratified the Energy Efficiency Directive, which calls for continued progress on energy efficiency to 2030, following the “Efficiency First” principle. But recent research reveals that Member States are already failing to meet efficiency goals established for 2020.

Happily, there are huge opportunities to save both carbon and money through energy savings such as renovated buildings, new industrial processes, advanced lighting, and similar measures. The missing ingredient is capital. Europe needs public funds to draw forth private capital to deliver efficient energy services to families and businesses across Europe. Fortunately, the perfect source of investment capital exists—carbon revenues from ETS auctions.

The European Union has long encouraged Member States to dedicate at least half of their carbon revenues to climate purposes, and there is ample experience across Europe on ways to invest ETS receipts. These include energy savings programmes like the business and residential refurbishment loans funded by the German KfW bank and the French Habitat Milieu housing programme, which delivers energy savings improvements to housing for lower-income families. Supports for renewable energy are also common across the EU. Unfortunately, this money sometimes also ends up backing projects that do not reduce emissions, such as national budget deficit reductions, and direct subsidies to energy-intensive industries.

RAP’s new research on carbon revenue recycling reveals that only one‑quarter of carbon revenues received in 2016 was reinvested in energy efficiency. Since deep efficiency is essential to the energy transition, can deliver direct benefits to families and businesses, but is difficult to deliver at scale without public supports, we can and should invest much more. The good news is that new carbon receipts that could drive higher efficiency gains are now becoming available.

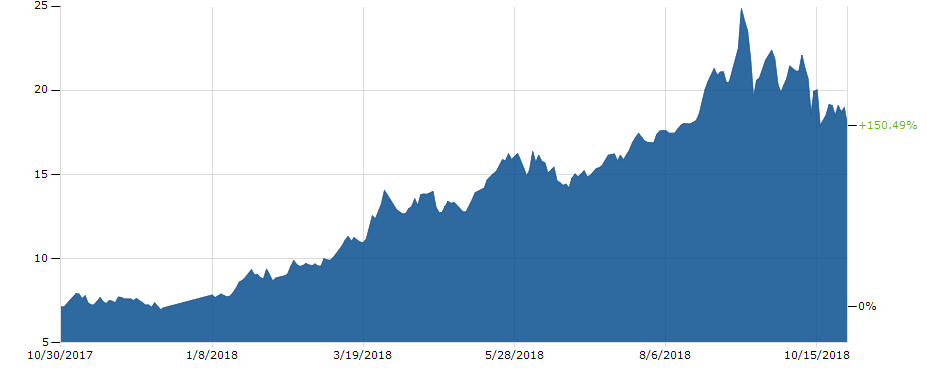

Rising carbon prices

Economic recovery and recent reforms to the ETS have pushed up emission allowance prices more than three-fold, from as low as 5 euros per tonne in 2017 to around 18 euros per tonne at the end of 2018. With future increases expected, it is possible that as much as 10 billion euros per year could now be available to EU countries to fund enhanced programmes for energy efficiency.

Growth in EU allowance prices, Source: Business Insider

The recent increase in total carbon revenues is not just a short-term blip. It is due to structural reform of the ETS: creation of the Market Stability Reserve, the prospect of permanent retirements after 2023, and continued reduction of the cap toward 2030. The stability reserve was created to address a large surplus of emission allowances that accumulated from 2014 to 2016. Adjustments to the number of allowances auctioned, based on pre-defined rules, are intended to eliminate the historic allowance surplus and better balance the carbon market going forward. Carbon revenues can be a significant source of public funding for long-term energy efficiency programmes that will magnify the carbon-reduction effects of the ETS while lowering energy bills for families, businesses, and EU nations.

Benefits for all

Experts agree that we cannot deliver rapid decarbonisation with supply-side energy solutions alone. Energy efficiency must play a key role in accelerating decarbonisation efforts. Fatih Birol, the executive director of the International Energy Agency, says, “The right efficiency policies could enable the world to achieve more than 40% of the emissions cuts needed to reach its climate goals without new technology.”

Capturing the untapped and cost-effective potential for energy efficiency improvements should logically be a major goal of climate policy. But many efficiency opportunities, such as buildings renovations and home heating improvements, and even industrial motors and commercial lighting retrofits, are blocked by non-price barriers that make many efficiency savings difficult to capture through market drivers alone.

A pricing instrument like the ETS simply does not deliver the savings that, in theory, it might. But well-designed efficiency programmes using carbon revenues can deliver as much as seven to nine times more carbon reduction than the carbon price alone. This is because they can overcome behavioural, financing, and legal barriers to efficiency investments. The resulting energy savings will also deliver multiple dividends in the way of additional emission reductions and reduced energy bills for consumers. They will also deliver a range of non-energy benefits such as health and air quality improvements, job creation, and European energy security.

Room for improvement

Since 2014, Member States have been required to report annually on their carbon revenues from ETS auctions and how they are used. RAP has taken a close look at these reports for 2016. In that year, EU countries received 3.8 billion euros in carbon revenues. According to Member States’ reports, around 61 percent of the total revenues were recycled for climate and energy purposes, as defined in the European ETS Directive. This percentage includes all reported strategic investments, excluding amounts from those countries that do not earmark their revenues for specific uses.

Even a quick look at these reports shows that there is room for improvement. Over 38 percent of total 2016 carbon revenues were not strategically used for energy and climate purposes, and only about one-quarter of available revenues was used to promote energy efficiency. Moreover, due to the broad latitude given to Member States, the reporting does not demonstrate whether spending is additional to that which would have occurred anyway.

On a more positive note, this study reveals that several countries devote a substantial share of their carbon revenues to energy efficiency. Nine Member States report using at least 50 percent of their carbon receipts for energy efficiency programmes, with France reporting a full 100 percent. RAP’s assessment of the energy efficiency programmes funded in part by carbon revenues in Latvia, Germany, and the Czech Republic shows clearly that carbon-funded energy efficiency improvements can deliver both emissions reductions and cost savings to consumers, along with tax revenues to national budgets, clean energy jobs, and economic growth.

There is ample experience across Europe, as in other carbon cap-and-trade regimes, that carbon revenues invested in high-value energy savings programmes yield myriad benefits. A leading example is the Regional Greenhouse Gas Initiative (RGGI), which caps emissions from power stations across nine northeastern states in the U.S. This region, on its own, would be the sixth largest economy in the world. The RGGI states have routinely devoted about 55 percent of their carbon receipts to energy efficiency programmes. In RGGI’s first six years, these delivered over 1.5 billion dollars in energy bill savings and over 2.76 billion dollars in net economic gains, while reducing emissions faster than expected and at a net negative cost to consumers per tonne avoided.

Deeper energy savings are an obvious, powerful, and affordable part of Europe’s climate strategy. The good news is that we know how to capture them. Some Member States are already leading the way. By increasing the amount of ETS revenues invested in energy efficiency, we reduce emissions, benefit consumers and businesses, and advance the energy transition. What are we waiting for?

A version of this article originally appeared on FORESIGHT Climate & Energy.