Every year households in the UK install about 1.7 million gas boilers. In May, the Heating and Hotwater Industry Council reported that 2021 looks to be a record year for gas boiler sales, with year-to-date sales up 41 per cent from 2020. So far, low-carbon heating occupies a small — although growing — niche in the heating market.

One important factor supporting a booming boiler market is quite simple: Gas is cheap and electricity is expensive. Residential electricity prices per kilowatt hour are currently around five times higher than gas prices. This means that switching to a heat pump, even with an efficiency of 300 per cent, does not offer bill savings for customers on a standard tariff.

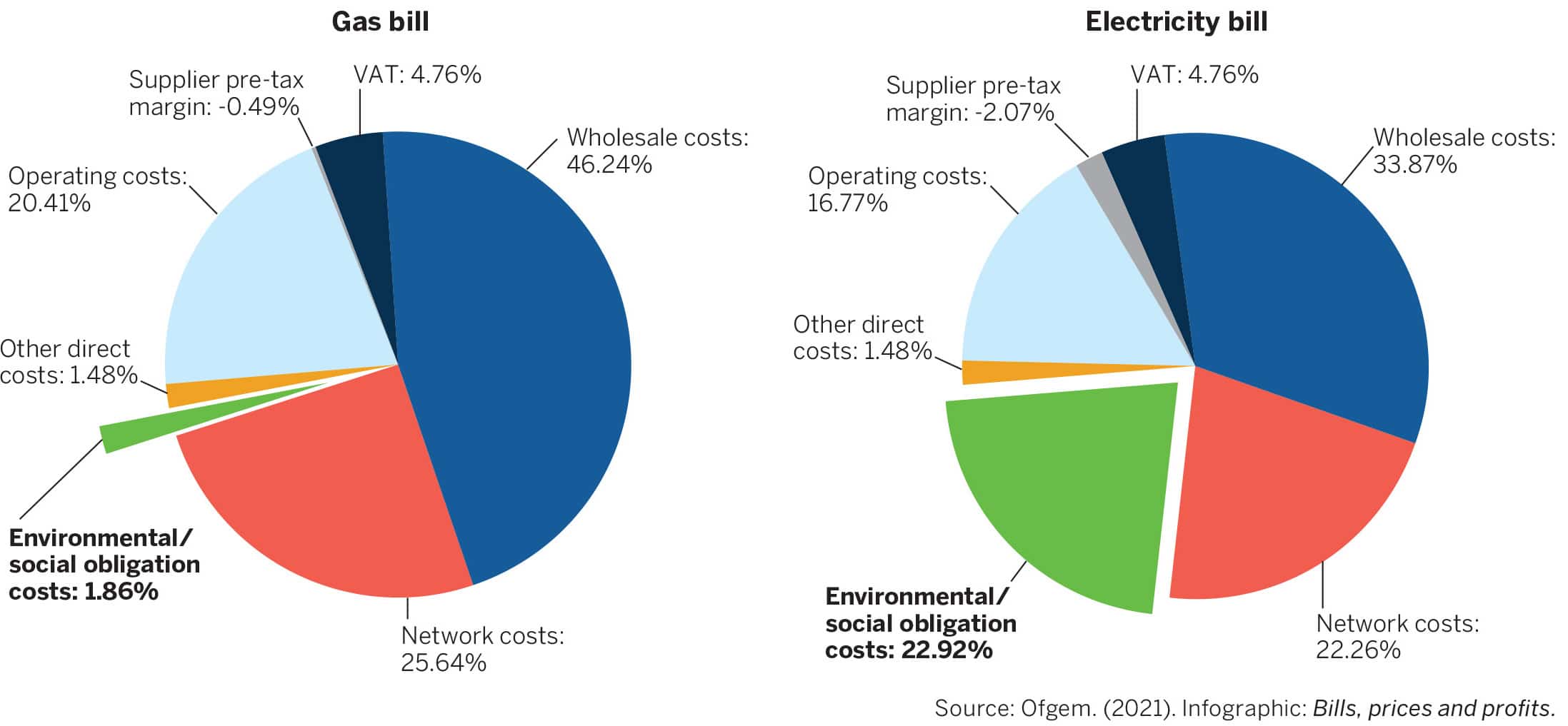

This is partly a political choice. Legacy policy costs drive part of the difference in price. Most of levy-funded energy and climate policies, which make up 23% of the total household bill, are presently paid for through electricity bills. In the UK, these legacy costs include charges for policies such as feed-in tariffs, the Energy Company Obligation, Contracts for Difference, the Renewables Obligation and the Warm Home Discount.

Most levy-funded energy and climate policies are presently paid for through electricity bills.

Electricity is also effectively covered by a carbon tax, the carbon price floor. By contrast, gas carries a mere 2% of environmental and social levies, and is not subject to a carbon price. Research by Oxford University shows that the current levy structure provides an active disincentive to adopt heat pumps, which is clearly at odds with the UK government’s goal of mass deployment by 2028.

In the past, when electricity was much more carbon intensive, such an approach could have possibly been justified. But electricity has now become cleaner than gas and is projected to emit only half of the greenhouse gases resulting from heating with fossil fuels by the mid‑2020s. A much needed rethink of levy costs could provide energy users with incentives that complement the need to fully decarbonise heating.

Other countries are introducing incentives

But how to do this? The government could take two potential approaches.

First, legacy policy costs could be moved from electricity to gas and other fossil fuel heating bills. Such an approach could act as a carbon tax proxy, reflecting the falling carbon intensity of electricity and encouraging a switch to increasingly clean power. For the average dual fuel bill, it would make very little difference if the levies recouped from gas were equal to those previously recouped from electricity. The total bill of a dual-fuel household would increase slightly, as levies from the 28 million households with electricity would be spread across 24 million households currently using gas.

Such a change, however, could also support other policy goals. Households that currently use electricity for heating are twice as likely to experience fuel poverty. For them, energy bills would come down, helping to meet statutory targets to reduce fuel poverty.

The Netherlands, which has one of the highest penetrations of fossil-gas heating in the world, has recently decided to take a similar approach. The Dutch government will increase taxation of fossil gas by up to 43 per cent by 2026 (compared to 2019 levels) and will lower taxation on electricity.

Second, a direct but modest carbon tax on fossil heating fuels could pay for the legacy policy costs and reduce the levies on electricity. This is an approach currently being discussed in Germany, where a carbon price of €25 per tonne of CO2 in 2021 rises to €55-€65 in 2026, after which an emissions trading system for transport and heating fuels will operate. The German government expects the new system to generate revenues of €40 billion from 2021 to 2024. The revenues will be used to lower the renewables surcharge on electricity and for financial support programmes, making the use of electricity more attractive. Sweden has also used this approach as part of the country’s heat pump deployment strategy over many decades.

A pragmatic approach to switching fuel is needed

Both of these approaches require policy reform and may face significant political barriers. A more targeted and potentially more pragmatic method would be to exempt the electricity used for running heat pumps from levies. Under such a scheme, households installing a heat pump would receive a discount on the amount of electricity used for heating. This option is attractive because it would not require major reform of either levies or taxes, but still offers an incentive to households to switch fuels.

Pragmatic levy reform can eventually tilt the market in favour of clean heating solutions and make high installation rates of gas boilers a thing of the past.

To meet the government’s target of 600,000 new heat pumps per year, about 2% of additional residential electricity demand would have to be exempted. Levies on a per-unit basis would remain constant for existing electricity consumption. Denmark has recently done just that: Since January 2021, electricity used for space heating is subject to the minimum allowable tax rate of just 0.8 øre (0.01 pence) per kilowatt hour of electricity. The Danish government is hoping that this incentive will help them roll out heat pumps faster and at a larger scale.

Levy reform, in one form or another, will be necessary to present a clear business case to households and the market. Without it, subsidies and regulation will constantly face the uphill battle of fossil-fuel heating’s lower running costs, a situation that is politically difficult and economically unsustainable. Pragmatic levy reform can eventually tilt the market in favour of clean heating solutions and make high installation rates of gas boilers a thing of the past.

A version of this article originally appeared in Green Alliance.