Unbalanced charging could put unnecessary stress on distribution grids

The European Union’s Alternative Fuels Infrastructure Regulation (AFIR), which entered into force mid-April 2024, requires Member States to scale up the buildout of truck charging capacity and density starting in 2025.

At the same time, charge point operators (CPOs) seek to develop the market for megawatt charging services by developing strategically located sites along the EU’s busiest freight corridors. The CPOs, however, face challenges with lengthy grid connections, scaling of capacities and high grid usage costs.

Steep price differences for the use of power networks in each country will affect the costs of operating megawatt charging locations along main EU freight routes. This will affect the CPOs and could negatively impact power grids. These discrepancies need to be addressed to ensure more cost- and grid-efficient megawatt charging and to help accelerate freight electrification in Europe.

Selected truck charging along central European freight routes (TEN-T Network)

Charging tourism

The costs of offering megawatt charging will vary strongly across the grid area in which the station is located. For instance, there is a significant difference in charging costs between Poland and Germany.

If charging a 400 kilowatt-hour (kWh) e-truck, there would be a difference of around €15 per charge, per truck, just for network costs, before taxes. Applied to several trucks per fleet and multiple border crossings a week, this can add up to a considerable cost saving for fleet operators in a very low-margin business.

It creates a strong incentive to charge where it is cheapest. The cost differences in border regions between Member States create the risk of “charging tourism.”

In contrast to the well-known fuel tourism, in which trucks refuel in countries where diesel is cheaper, charging tourism will have wider system impacts. If all electric trucks charge at the same, cheaper sites, local grids would be overloaded while leaving neighbouring grid capacity unused — increasing costs for all consumers.

Although it is important that fleet operators have the choice of where to charge their trucks, charging tourism will expose the weaknesses of current network tariff regulation in European Member States.

Unfit for purpose

The largest regulated operational expense for operators of charging sites, after purchasing electricity, are the costs of using power networks. Local grid operators charge for usage via network tariffs, which are set by national energy authorities.

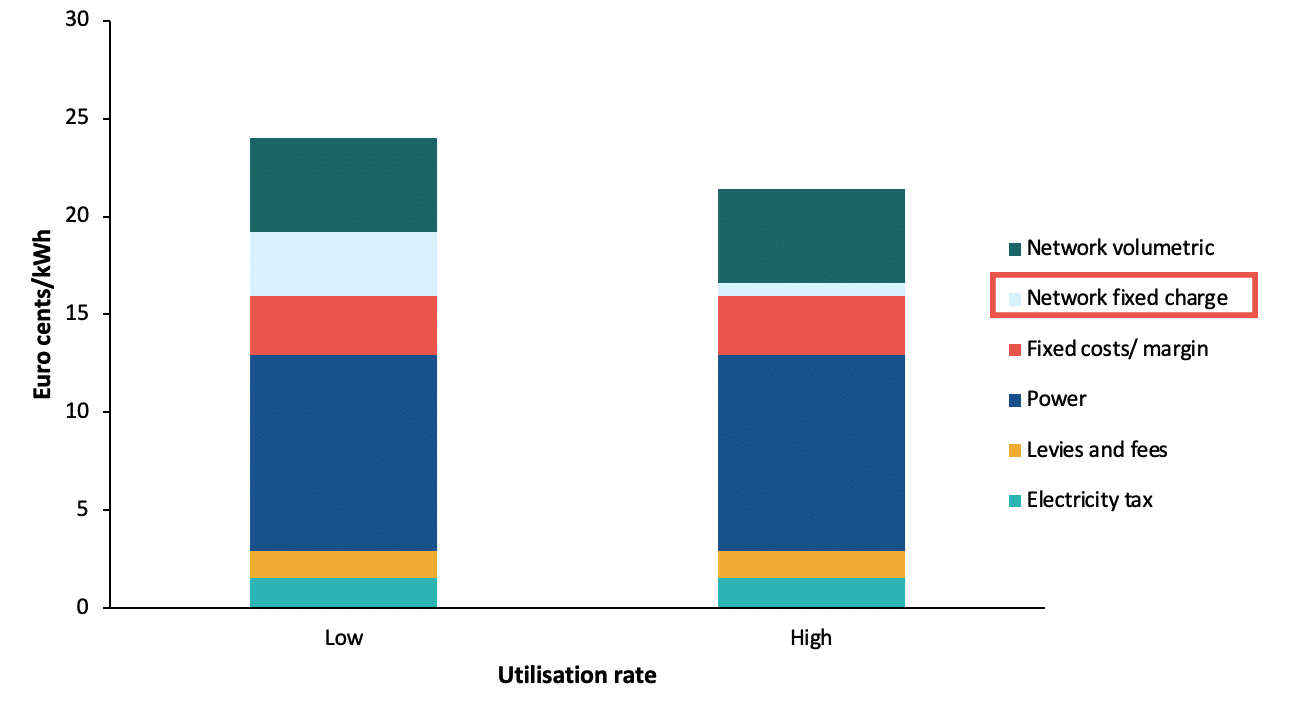

Current network tariffs, however, are not well suited to very “peaky” truck charging, especially in the early market when few trucks are likely to charge. These low utilisation rates are particularly expensive with the current network price design. In the case of a large distribution area in Western Germany, operating a charging point with low utilisation will cost a CPO €15 more per 500 kWh than a charging point with a high usage rate. This makes the business case difficult for CPOs.

Comparison of 2023 costs for operating a megawatt charging point by utilisation rate

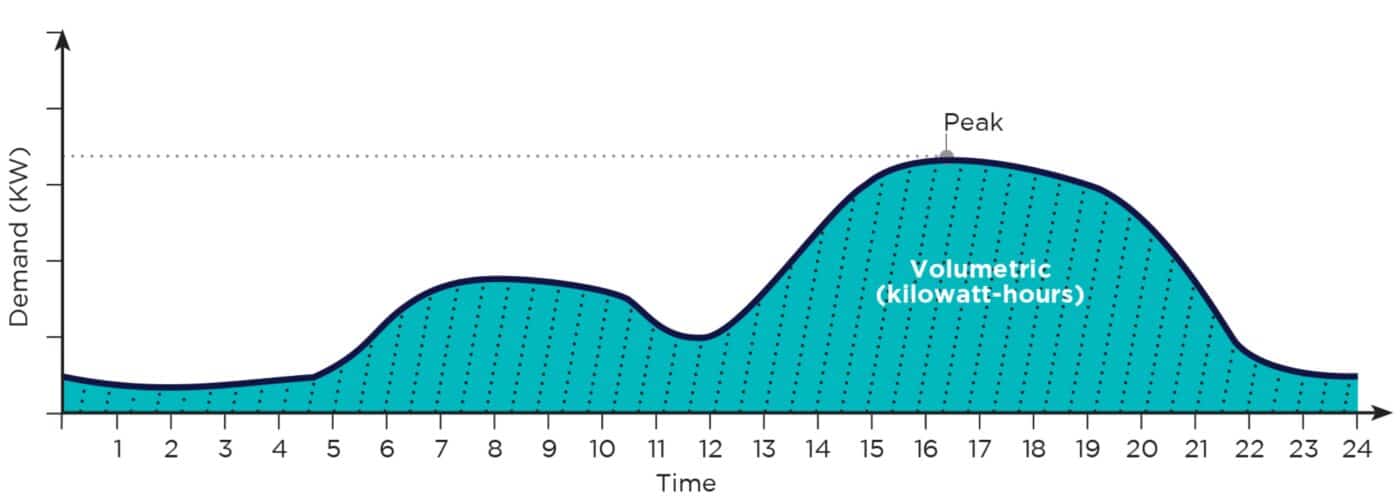

The main cause for this issue is most European Member States’ current network tariff design. Grid operators recover a significant part of network costs through a demand charge (€/kW) based on the annual peak capacity required for the charging site, as illustrated below.

The more suitable design for CPOs in the megawatt charging business would be to recover those costs based on the volume of electricity used (€/kWh), shown in the figure’s turquoise curve. This price varies over time depending on network usage, with lower prices at times of lower electricity demand on the grid. This change in network tariff design would even out the disadvantage for CPOs during early market uptake.

Illustrative curve of energy consumption and network charges

Treating the cause

New problems require new policy solutions. In times of fuel tourism, governments have used taxation policies to attract consumption. For instance, the Belgian government lowered a diesel tax to attract truck traffic from Luxembourg. Adjusting electricity taxation at truck charging sites to combat charging tourism can address the short-term effects of concentrated truck charging. But these types of fiscal policies only treat the symptom, not the cause.

Network pricing should become more cost-reflective everywhere to alleviate the risk of charging tourism and support a speedy buildout of truck charging infrastructure.

A first step would be to base power network pricing not on demand charges for the peak capacity provided throughout the year but on volumetric charges for the actual electricity sold at the charging point. The latter must be time-differentiated to reflect actual grid conditions.

Charging would, therefore, be cheaper in times of ample grid capacity and more expensive when the grid is already stressed.

Introducing price signals from the grid would give all customers, including CPOs of megawatt charging sites, incentives to optimise consumption and make charging smarter. The fundamental importance of cost-reflective network pricing to advance the energy transition is already recognised by European energy regulators, but is not yet well implemented in Member States.

Truck charging is yet another example of why reforms are key and should be tackled without delay. Without reforming network tariffs, the anticipated growth of e-trucks risks causing unnecessary costs in the system and, as a consequence, slowing down the transition to clean energy and clean transport overall.

A version of this article originally appeared on Foresight Climate & Energy.

Photo credit: ThomBal from Shutterstock.