I frequently receive requests for advice based on my personal experience as an owner of a heat pump and an electric vehicle. Often I get asked whether I now pay more for my energy than before. People are more keenly aware today of the high costs of electricity and they hesitate to switch away from fossil fuels if it costs them more money.

This is concerning because in most, if not all, independent analyses of pathways to net zero, emissions electrification plays a critical role. Two sectors in particular can benefit from direct electrification: buildings and transport (although there is also significant potential in industry). Not only can electrification deliver substantial carbon reductions and immediate air quality improvements, it can also provide financial benefits to customers through energy cost savings.

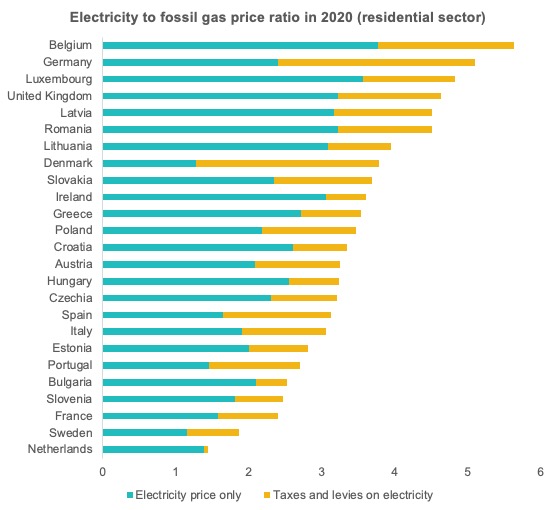

But households often face an important barrier to electrification; the economics of switching away from fossil fuels may simply not stack up. Whilst electric cars already today deliver cost savings over their lifetime compared to petrol and diesel cars, the case is less clear for heat electrification using heat pumps. This is because the price ratio of electricity versus fossil gas is unfavourable in most European countries. Part of the reason for electricity being, on average, 3.3 times more expensive than fossil gas are taxes and levies on electricity (although there are also some levies and taxes on gas but at a much lower level). Much of this is a result of policy and regulatory choices and can be resolved through reform.

Electricity is, on average, 3.3 times more expensive than gas

In many countries the costs of renewable energy deployment and integration have been added to electricity bills. The most prominent example of this is probably Germany where the costs of feed-in tariffs have been added to electricity over the years and now make up about 20% of the average electricity price. In addition, the industry sector is sometimes exempt from energy taxes and levies that residential customers pay. This shifts the burden more to other consumers and thereby further increases the ratio between electriciy and gas prices for households.

Source: European Commission. (2020). Energy prices and costs in Europe.

Even though heat pumps — the most efficient form of heat electrification — can deliver heat at a very high efficiency of around 300% or more, the relatively higher electricity prices can prevent sufficient cost savings that would justify switching from fossil gas to a heat pump. It is for this reason that the International Energy Agency has called for narrowing the gap between electricity and natural gas prices to accelerate the uptake of heat pumps. Furthermore, whilst it might have been directionally correct to put most of the costs of decarbonising the economy on electricity when its emission intensity was very high, this is no longer the case. In many countries electricity is now cleaner than gas and the expectation is that emissions will fall even further as we deploy more renewables at record speed. This puts into question whether the existing tax and levy regime is appropriate anymore. Given the ambitious decarbonisation goals and the need for large-scale electrification, it is no longer fit for purpose.

Regulatory reform is underway

Countries looking at reducing heating emissions through electrification recognise this and have begun reforming energy taxes and levies as part of building a clear business case for electrification. The country with one of the highest penetrations of fossil gas heating in the world, the Netherlands, has recently decided to support the transition from fossil gas to low-carbon heating through energy tax reforms. The government will increase taxation of fossil gas by up to 43% by 2026 (compared to 2019 levels) and will lower taxation on electricity.

Denmark is currently implementing similar steps: The Danish Climate Agreement for Energy and Industrycommits the government to reducing taxes on green electricity for heating, while simultaneously raising taxes on fossil heating.

In other countries there is a lively discussion around energy taxation and levies in the context of net zero emission goals. In the UK, for example, the Environmental Audit Committee of the House of Commonsrecently pointed out that current electricity prices — being about five times higher than gas prices — were an active disincentive to electrification. The committee has called on the government to set out its plans for rebalancing legacy policy costs to make heat electrification more attractive.

In addition to shifting levies to gas, some countries have opted for a carbon price on fossil gas — an approach that Germany has recently adopted. But the more existing levies and taxes we can rebalance, the lower any carbon price would need to be to have the same impact. And rebalancing existing levies and taxes will lead to no additional cost to the average consumer.

Shifting taxes and levies also faces some challenges. Over time, and as the amount of gas consumed for heating falls and the number of homes heated with gas declines, the environmental and social levies will fall on fewer customers and fewer units of gas being consumed. At the same time some legacy policy costs will eventually decline once past commitments have been paid off.

Low income customers need to be protected

When rebalancing taxes and levies, it is also critical to carefully assess the impact this will have on low-income customers. Shifting taxes and levies should be done in a way that has minimal net impact. Those customers heating their homes with elecricity would benefit from lower bills. This is important because in many countries — for example in the UK and Austria — a proportionally higher share of low-income customers use electricity for heating, which is often very expensive. These households would benefit. But low-income customers living in very ineffiicent buildings with a gas or heating oil boiler would pay more if they consume above-average amounts of gas. For these customers, additional policies will be needed to offset negative impacts through targeted energy efficiency and electrification programmes and direct social welfare payments towards their bills in the short to medium term, a mechanism used in some European countries already.

Rebalancing taxes and levies is a key ingredient in the energy transition towards more electrified end-uses. Of course we will need other policies to work in tandem with rebalancing taxes and levies, such as regulation that sets out a clear long-term trajectory for phasing out fossil fuel heating. Taking advantage of it means that we improve the business case for electrification at no or little additional cost to consumers. And next time someone asks me for advice, the question about the running costs would not even come up as the business case was clear.

A version of this blog appeared in Euractiv.