As the electrification of vehicle fleets goes mainstream, fleet owners are facing a gauntlet of challenges, starting with engaging their electric service provider. The utility response of providing “advisory services” is both creative and presents new challenges for utility and air regulators.

Advisory services, whether offered by utilities or third parties, are designed to educate and enable fleet managers. The goal is to fill the gap between what fleet managers already know about transportation and what they need to know about electric transportation.

RAP recently facilitated a conversation on this topic, inviting a representative of a school district, a utility company, and several third-party transportation service providers to discuss their perspectives and better understand the challenges.

In our webinar, “So, How Does This Work Again? The Role of Advisory Services in Fleet Electrification,” Timothy Shannon, transportation director at the Twin Rivers, Calif., Unified School District; Matt Stanberry, managing director at Highland Electric Fleets; Ann Xu, founder and CEO of ElectroTempo; and Jason Peuquet, strategy and policy manager of clean transportation with Xcel Energy, shared their perspectives with RAP’s Camille Kadoch.

From my perspective as a former utility commissioner, I was asked to serve as the “respondent” and identify the pertinent regulatory issues.

Reviewing Advisory Services Proposals

At first glance, the expansion by utilities from offering a commodity to offering professional services may seem unprecedented. But actually, advisory services are a more visible form of what utilities used to refer to as “marketing key accounts,” a focus that utilities regularly had that helped them stay in touch with sizable commercial and industrial customer segments, and for which they were allowed to recover reasonable expenses.

The point here for regulators is not that this is different, but instead that this is more overt, and coming at regulators in a more robust and comprehensive manner. Advisory services also have a component of market development, a similar quality found in demand-side management programs. Note that third-party support to help utilities better serve fleets is not so different than the energy auditing support that contractors provide energy efficiency programs.

So what have we learned from those experiences, and how do we apply what we’ve learned in this context? This history can help regulators understand how to proceed when a utility says it wants to engage in these ways, that it will incur costs for which it wants recovery, and possibly even that it seeks earnings on those costs.

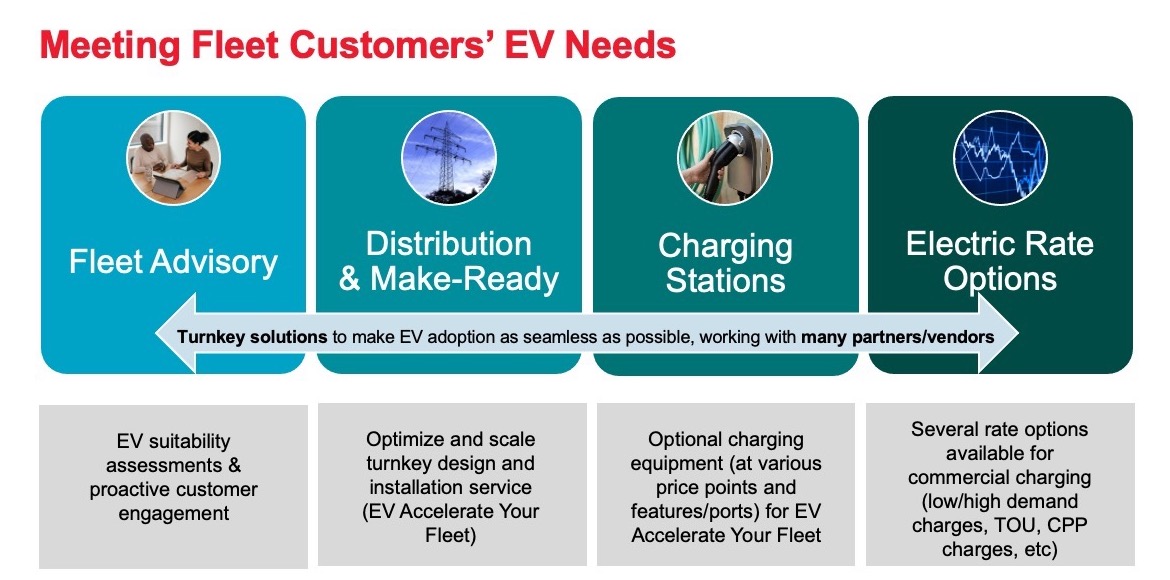

What is the right regulatory construct to apply here and what needs to change? The slide below provided by Xcel’s Jason Peuquet, does a good job of illustrating the range of comfort to discomfort of the regulatory process in this context. On the right-hand side, regulators are comfortable with rate design. We’ve had a 100-year history with that. Advisory services the new phenomenon over on the left about which we are less certain. The pieces in the middle come with a different levels of comfort.

Source: Xcel

Costs and Benefits

Electrification means that a utility is creating new load. But the regulator still has a key role to determine the answers to two questions: Is the utility proposal creating the kind of load that is appropriate? And is the load being managed effectively from a system benefit perspective? The regulator needs to ask:

- What is the utility aspiring to do or become?

- How does this new service change the utility’s current role as a public service?

- Does investment in advisory services align with existing regulatory principles — i.e., are these investments just and reasonable? And are they least cost?

- How should costs be allocated — i.e., who pays for them, and why?

- Do today’s costs deliver future societal benefits, however difficult they may be to quantify?

A narrow interpretation would focus on who is the cost causer and what they should pay. That would put all the burden back on the fleet services. That is fine, and internally consistent in a narrow framework.

But recognizing that we are working in a broader arena, we acknowledge that we are not just making investment to help fleets. We are doing “demand creation.” This puts the regulator in a position to look at today’s costs that are known and knowable, and at future benefits that are speculative and uncertain — although we know they are out there. How do we get comfortable matching today’s costs with future benefits? Those benefits range from consumer savings, to lower-cost grid management, to the many societal benefits like reduced air emissions and improved health outcomes.

21st Century Load Forecasting

At the same time regulators need to recognize that doing this work — letting utilities build load through advisory services — ushers in a new aspect of load forecasting. Fundamentally, the regulator-utility relationship will need to further evolve. Effective regulatory oversight of load forecasting requires greater engagement of the utility, with lines of inquiry such as:

- Will advisory services requests be strategic and narrow, seeking only to develop certain types of load?

- What kind(s) of load do you want?

- Do you just want maximum growth, no matter where it comes from?

- Where on your system do you want it?

- At what time of day do you want it?

Requests for approval of advisory services will bring with them a new complexity about understanding load. So, this is not only an inquiry into costs and benefits (both short- and long-term); it is also a challenge into understanding how the utility is changing its relationship with certain customers — from the traditional provision of a commodity, a blended commodity and service-based relationship. The regulator is confronted with understanding that this service-based customer engagement is interwoven into utility decisions concerning capital asset investments in infrastructure. For it is through effective advisory services that these capital assets become viable and reasonable assets.

Finally, in this world where the utility has the onus to make and justify these proposals, it is the regulator’s role to ensure that the utility is clear in what it aspires to become. And this will require even more questions for regulators to raise:

- How does this service fit in the utility’s portfolio?

- What is the utility’s longer-term sense of itself as a commodity and service provider?

- Is the regulatory called to assist them and nudge them on their way? Or on the contrary, is your task to “keep them in their lane?”

- How am I going to manage the commission’s relationship with that utility into the future?

One way or another, transportation electrification represents a new set of evolutionary forces upon the utility-regulator relationship. Awareness and preparation will make the ride more enjoyable.