Europe has been paving the way to greater residential demand flexibility since 2018, and according to RAP’s recent survey, residential smart tariff offerings have increased by 250% since the energy crisis hit in 2022. Let’s look at how European countries achieved these gains, and how the U.S. can too.

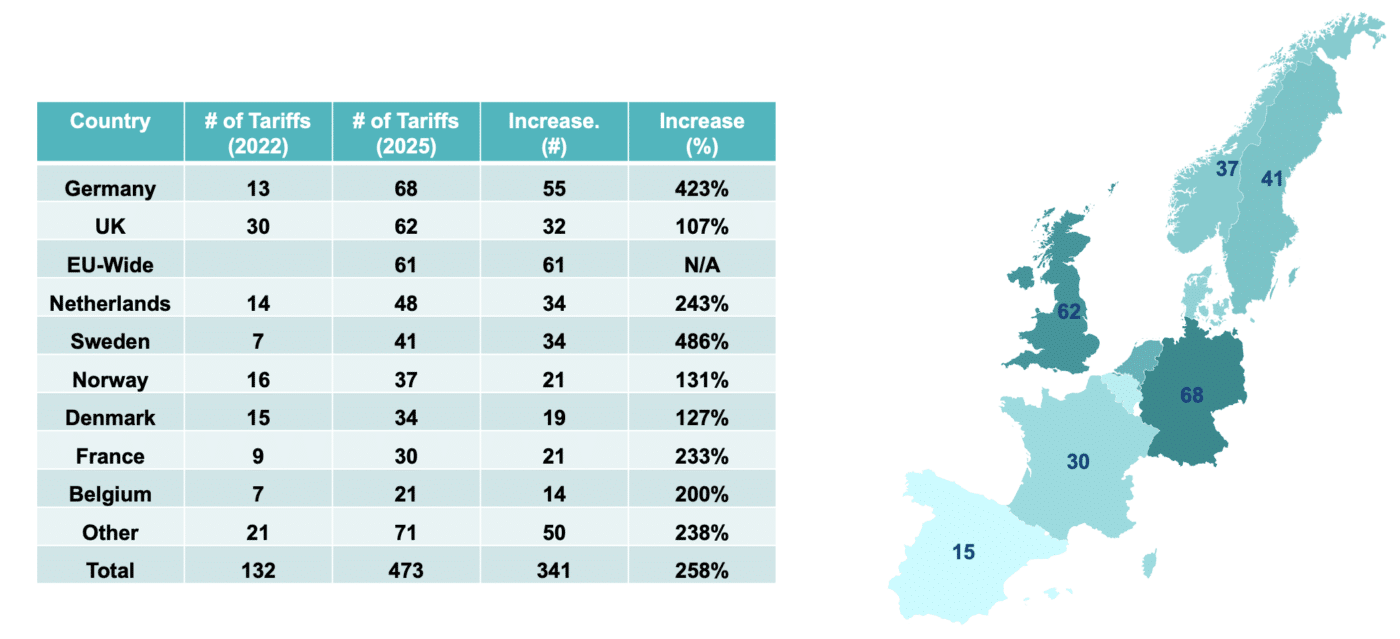

Smart tariffs combine time-based prices with automated technologies that can control residential end uses, such as thermostats, heat pumps, water heaters and electric vehicle chargers. The combination saves customers and their utilities money. These products and services are pervasive across Europe as shown in Figure 1 and are the result of a three-part approach to flexibility.

Figure 1. Growth in Smart Tariff Offerings in the EU

Part 1: Empowering Retail Customers

In 2018 and 2019, the European Union (EU) Parliament passed a series of directives and regulations that, according to this study, entitles customers to do three things.

- Act as active consumers (2019/944, Article 15.1) and specifically become renewable self‐consumers (2018/2001, Article 21);

- Aggregate (2019/944, Article 13);

- Sell self‐generated electricity and participate in flexibility schemes. (2019/944, Article 15.2).

These changes not only empowered customers but also led to a major change in the way that system operators perform. Under these regulations, “member states were requested to ensure that both transmission system operators (TSOs) and distribution system operators (DSOs) consider Demand Response through aggregation in a non‐discriminative manner when procuring flexibility.” This effectively moved them from operating only supply-side resources to actively operating both supply-side and demand-side resources. This increased their choice of resources and helped reduce their costs in the electricity market.

Thanks in part to FERC Order 2222, the U.S. is already on the path to empowering retail customers by giving them greater access to wholesale markets. State utility commissions that wish to emulate the European example can require their distribution utilities to procure demand response in a non-discriminatory manner and consider taking steps to move them in the direction of becoming a distribution system operator.

Part 2: Collaborating on Pilot Projects

Importantly, these changes led to a series of collaborative pilot projects. These projects sought to stack the value from multiple grid products, including energy balancing, congestion management, and voltage and frequency regulation. This required collaboration across the full breadth of the electricity industry, from retail customers and their aggregators to the utilities, DSOs and TSOs. Furthermore, the collaborations took place amongst and between multiple EU Member States. This increased interoperability and value stacking, and importantly, it prepared the EU to quickly respond during a time of crisis.

Although the U.S. has conducted many pilot projects, interoperability and valuation remain a challenge. State utility commissions that wish to emulate the European example can open proceedings to investigate and adopt the National Institute of Standards and Technologies Smart Grid Interoperability Standards and to value the full stack of costs and benefits using the National Standards Practice Manual for Cost Benefit Analysis of DERs.

Part 3: Responding to the 2022 Energy Crisis

In February 2022, Russia invaded Ukraine, causing a year-long spike in natural gas and electricity prices. This not only increased prices, it highlighted Europe’s dependence on Russian-supplied natural gas. Thanks to its preexisting policy and collaborative pilot projects, Europe was well prepared to respond to the price spike. The following year, high prices and calls for collective action reduced electricity and natural gas consumption by 22% and nearly 18%, respectively. Even after the initial price shock abated, the focus on energy security remains, and many Member States now require their electricity suppliers to offer more “smart tariffs.” This has resulted in an explosion in new tariff offerings as illustrated below.

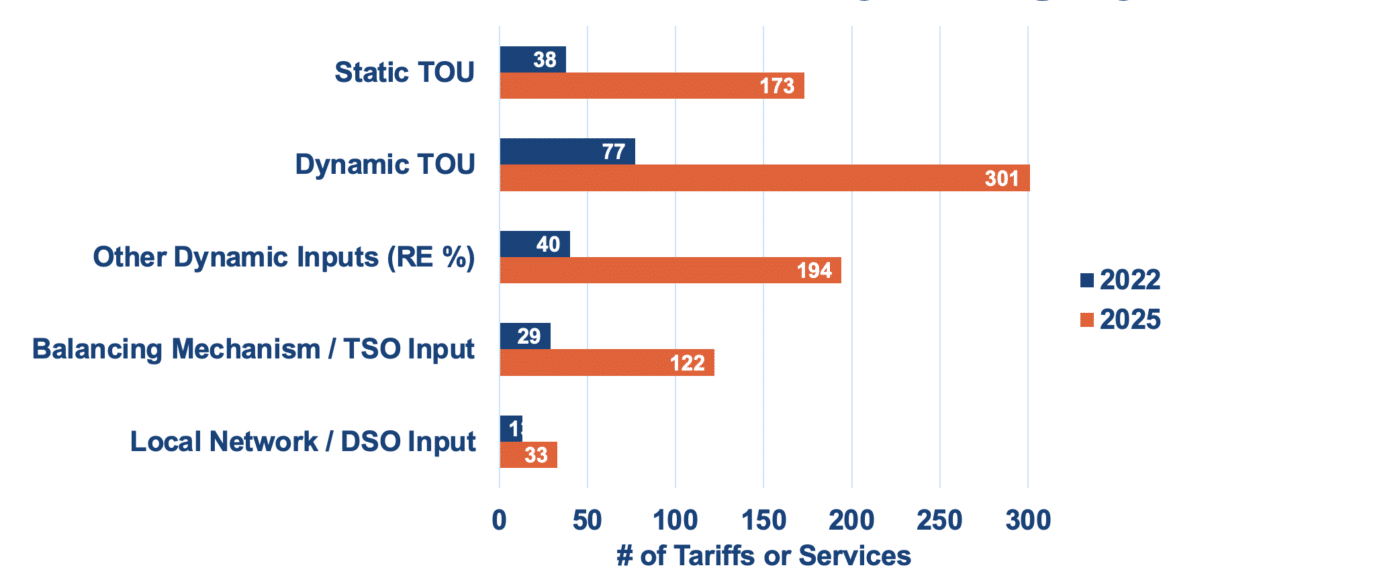

Figure 2. The Growth in Smart Tariff Offerings by Category

These tariffs use Home Energy Management Systems (HEMS), dynamic price and volume signals and algorithm and/or AI-driven decision making to deliver demand-side flexibility to the grid. Importantly, these programs continue to deliver the heating, cooling and charging services that customers require. They simply make it easy by optimizing and automating the customer’s response to the grid’s price and volume signals.

State utility commissions that wish to emulate the European example can investigate the Lawrence Berkley National Labs’ DER Integration Framework, and consider creating a grid services tariff for DERs. Using LBNL’s framework, commissions may also investigate the merits of conducting a bidirectional cost of service study and designing export tariffs.

Conclusion: Why wait for the next energy crisis?

Thanks to Europe’s experience, the road to residential demand flexibility has been paved, and the US has already taken the initial steps to travel down the same road. In fact, according to recent U.S.-based studies, the residential sector can deliver affordable, grid scale services today. If the affordability benefits can be had now, why wait for the next energy crisis to act?