We know that Target, Wal-Mart, Costco, Ikea, Kohl’s, and other big-box retailers have installed a lot of rooftop solar. They’ve mostly been doing so under net metering rules, and paying the demand charges for their net load on utilities when their individual peak demands occur.

Utilities may think that they are protected in this sector by demand charges. Not so, because battery costs are coming down rapidly.

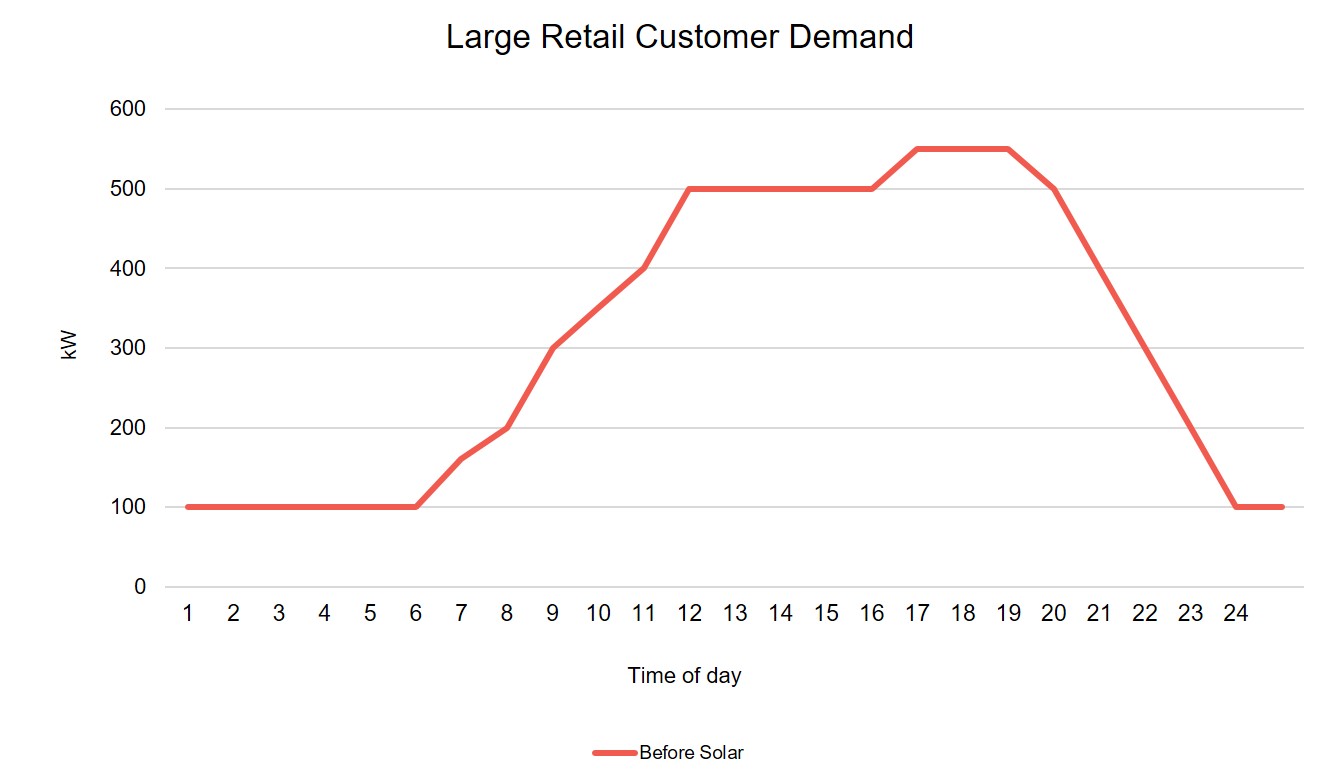

Take the load shape of a retail big-box load without solar or storage. There are minor overnight loads, and the lighting and air conditioning loads grow through the day, peaking in the late afternoon and early evening.

This building has a 550 kW maximum demand, 100 kW overnight minimum demand, and a load factor of 56 percent.

In order to reduce its peak demand to its average demand of 310 kW, this retailer would need about 1,900 kWh of storage. (Ignore the battery round-trip losses for now, for convenience. They are real, but are off-peak energy costs.)

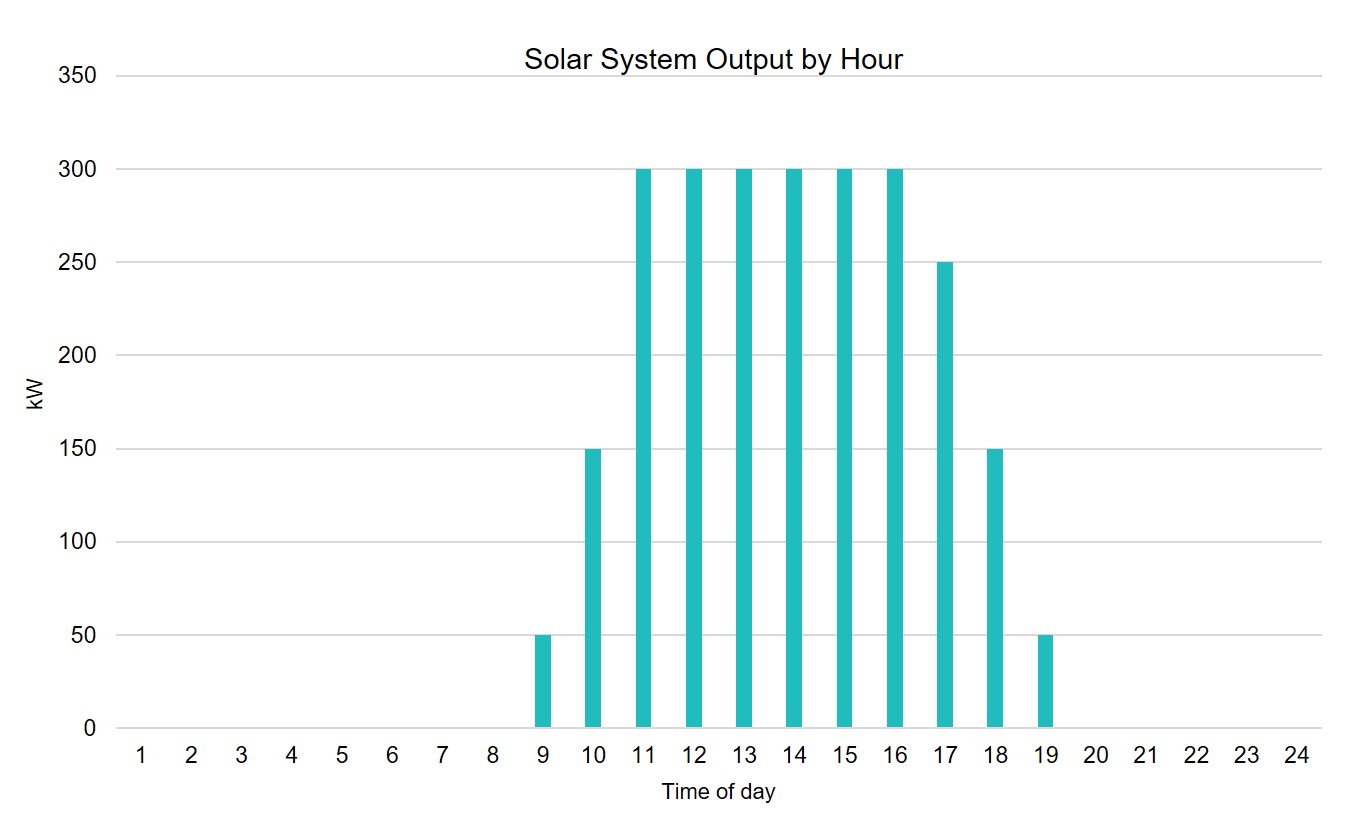

Now, say this customer installs 300 kW of solar. This amount would allow it to stay below its minimum load during the solar day, so it would not be backfeeding power to the grid, and thus need not be concerned about net metering rules. Just an interconnection permit would be required to run in parallel. The solar system has an output shape something like this:

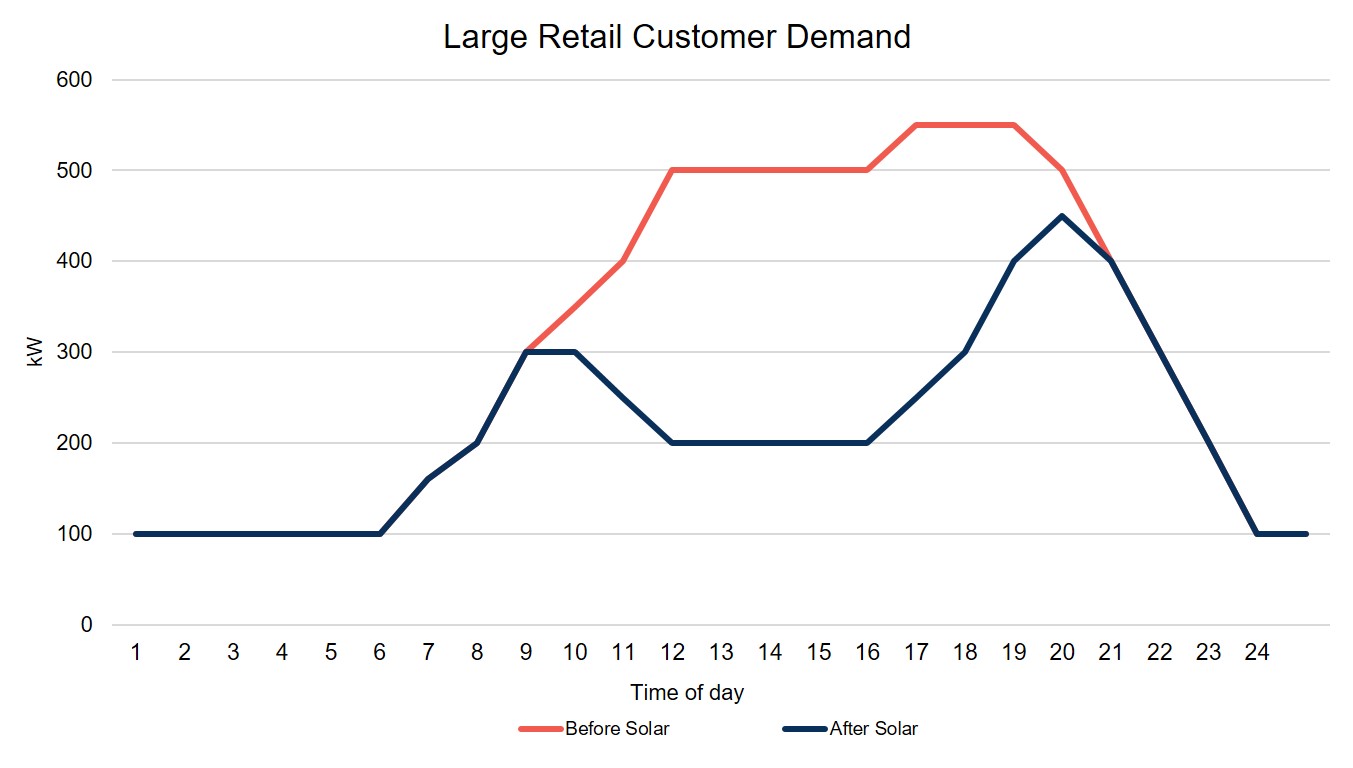

That leaves our customer with a net load shape to be served by the utility that is very different.

The broad peak has given way to a very short peak that’s driving a new, lower demand charge. The load factor has declined from 56 percent to 47 percent.

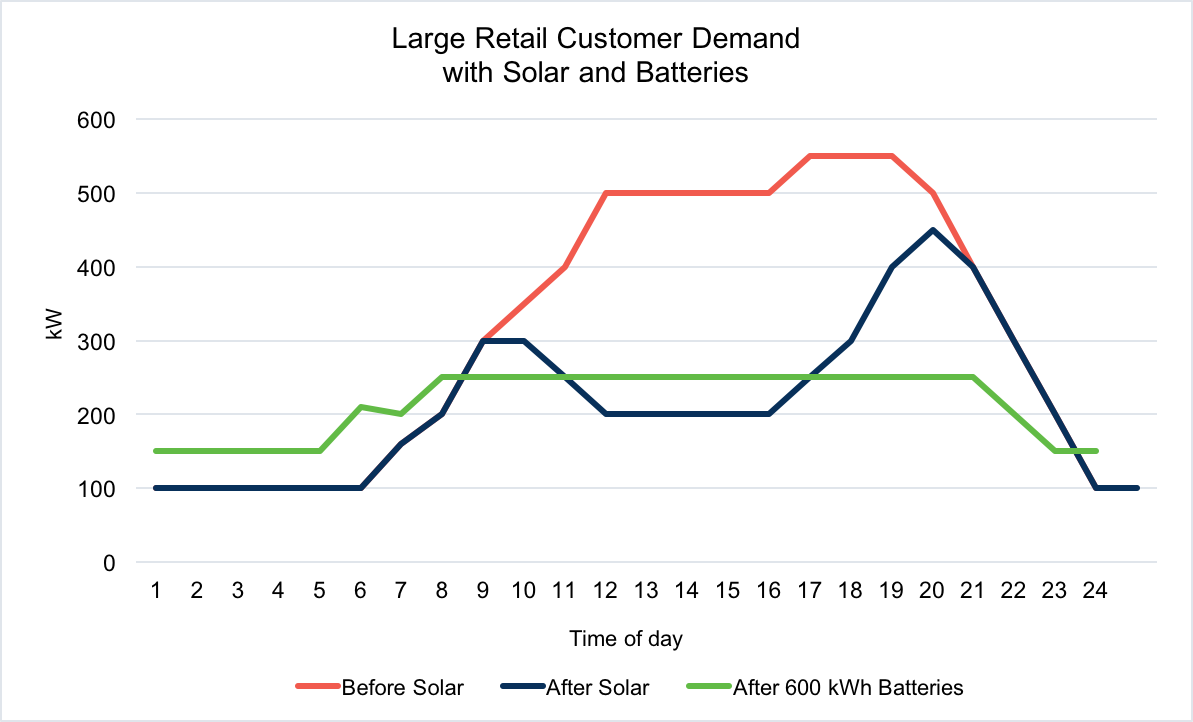

But the solar installation has dramatically reduced the number of hours causing the peak. It’s gone from a broad daytime/early evening peak to a narrow evening peak. This customer needs only about 600 kWh of storage to reduce its peak demand to 250 kW from 450 kW, using it a bit in the morning and a bunch in the early evening. At $200/kWh, that would be $120,000 of battery investment. If the demand charge is $10/kW, that’s $2,000 per month in demand charge savings. So, it’s a five-year payback, before considering any savings from time-of-use rates making overnight purchases to charge the batteries for the morning period less expensive (or the round-trip losses).

The new load shape enabled by the battery storage is shown by the green line above. Every gross dollar the customer saves is one the utility loses. Just as big demand charges have driven the ice storage air conditioning industry (Calmac says their systems regularly pay for themselves in two to six years—a time frame their customers will accept), demand charges will drive other forms of storage where the charges are high and the number of hours is small.

Based on what we see here, retail-sector solar is something to watch. The economies of scale are good and operating hours are long and include weekends. Further, the demand charges are often high, the access to capital is OK, and the payback periods are attractive.

Retail-sector solar may be a big shoe when it drops.

A previous version of the solar system output graphic in this blog showed incorrect hours. We apologize for this error.